US EV Sales Jump 5% As Legacy Brands Offset Tesla’s Losses

- More than 101,000 EVs were registered in the US in October.

- Registrations were up 5 percent on the same month in 2023.

- Tesla’s numbers dropped 1.8 percent, but it remains miles ahead.

We’re constantly hearing about an EV downturn and how automakers are changing their electrification strategies because consumers aren’t consuming. And sure, sales of electric cars are down in countries like Germany, but in the US people are still buying EVs, and they’re buying more of them than they did 12 months ago.

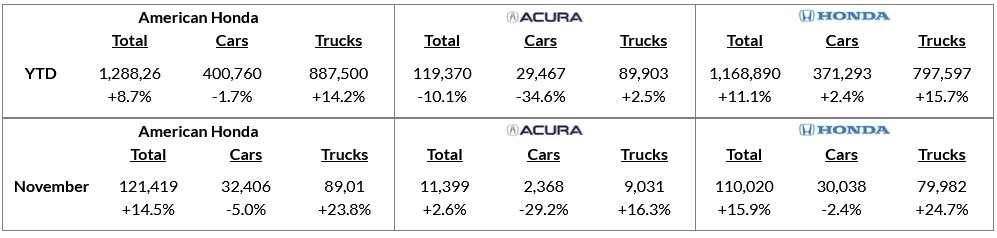

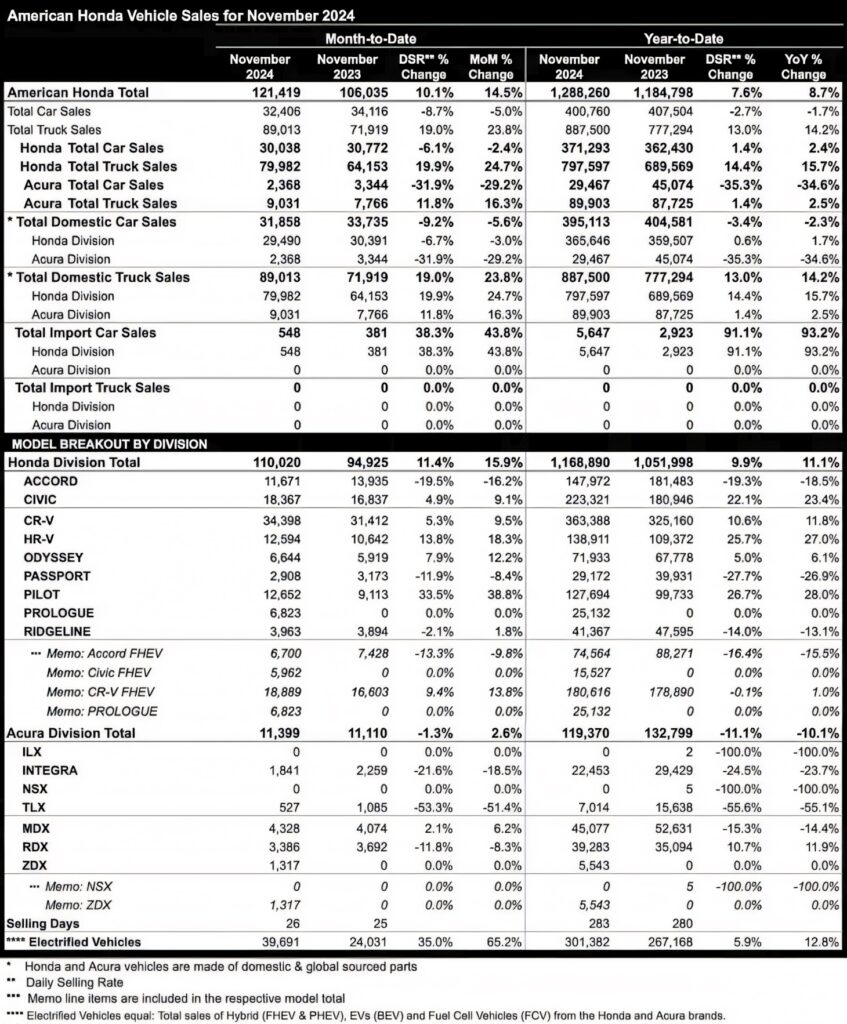

EV registrations climbed 5 percent in October versus the same month in 2023, topping out at 101,403, according to data from S&P Global Mobility. And it wasn’t Tesla driving that growth, but legacy automakers.

Related: Global EV Sales Shatter Records In November Thanks To China’s Unstoppable Growth

Chevrolet’s EV sales jumped 38 percent to 6,741 helped by demand for the Blazer and Equinox, while Cadillac Lyriq registrations grew threefold to 2,489 and the Hummer shifted 1,015 electric trucks, four times as many as it did last October.

Like the Equinox, Honda’s Prologue, which is built on the same GM platform and in the same Mexican GM plant, wasn’t available in 2023, but made its presence felt this year. It found 4,168 homes, only 12 fewer than Chevy did of its version. Hyundai’s Ioniq 5 facelift also gave its sales numbers the desired nip and tuck, boosting registrations from 3,555 to 4,485.

Although the overall number of EV sales is up, the rate of growth has slowed and some models registered fewer deliveries than previously. The Ford Mustang Mach-E, for instance, was down from 3,949 to 3,479 according to S&P Global Mobility’s spreadsheet and Rivian R1S sales dropped by more than 500 to 2,456. There are also fears that the EV segment relies heavily on tax credit availability to boost demand, and public interest could wane if Trump pulls the plug on the incentives when he takes office.

BEST SELLING EVs USA

| MODEL | OCT-24 | OCT-23 |

| Tesla Model Y | 21,787 | 25,220 |

| Tesla Model 3 | 17,419 | 16,237 |

| Hyundai Ioniq 5 | 4,485 | 3,555 |

| Chevrolet Equinox | 4,180 | 0 |

| Honda Prologue | 4,168 | 0 |

| Tesla Cybertruck | 4,041 | 0 |

| Ford Mustang Mach-E | 3,479 | 3,949 |

| Chevrolet Blazer EV | 2,561 | 167 |

| Cadillac Lyriq | 2,489 | 887 |

| Rivian R1S | 2,456 | 2,961 |

| Total | 67,065 | 52,976 |

Tesla’s registration numbers actually fell by 1.8 percent, and if you remove Tesla from the equation, EV sales increased not by 5 percent, but by 11 percent. And this isn’t a blip for Tesla: the automaker’s numbers have fallen in seven of the first 10 months of 2024, Auto News reports, and that’s despite the facelifted Model 3 and Cybertruck being new for this year. While the Model 3 gained ground, the Model Y fell back, sales tumbling from more than 25,000 to under 22,000.

But before anyone gets the idea that Tesla is falling behind in the EV race, we should make clear that it still outperformed the second best-selling brand’s EV models six times over. Or every single brand in the 2nd to 12th spots combined.

EV REGISTRATIONS USA

| BRAND | OCT-24 |

| Tesla | 45,200 |

| Chevrolet | 7,427 |

| Ford | 6,669 |

| Hyundai | 5,628 |

| Honda | 4,168 |

| Kia | 4,040 |

| BMW | 3,561 |

| Rivian | 3,502 |

| Mercedes-Benz | 2,989 |

| Nissan | 2,647 |

| Cadillac | 2,504 |

| GMC | 1,912 |

| Audi | 1,731 |

| Toyota | 1,438 |

| Acura | 1,261 |

| Porsche | 1,211 |

| Subaru | 1,115 |

| VinFast | 906 |

| Lucid | 623 |

| Lexus | 488 |

| Volvo | 452 |

| Genesis | 415 |

| Mini | 350 |

| Jaguar | 279 |

| BrightDrop | 228 |

| Polestar | 187 |

| Fiat | 135 |

| Fisker | 110 |

| Volkswagen | 92 |

| Jeep | 63 |

| Rolls-Royce | 38 |

| Dodge | 25 |

| Ram | 6 |

| Maserati | 3 |