Richard Hammond Once Crashed A Rimac, Now Trusted With BYD’s 2,978 HP Hypercar

- The YangWang U9 Xtreme makes 2,978 hp from four motors.

- Former Top Gear host drove the limited-run model on track.

- He also sampled the Xiaomi SU7 Ultra and Maextro S800.

China’s most outrageous new hypercar has already brushed up against the outer limits of physics, and now it has handed the keys to Richard Hammond. Last year, the YangWang U9 Xtreme went faster than any production car before it, recording a one-way top speed of 308.4 mph or 496.22 km/h at the ATP Papenburg high-speed oval in Germany.

Because the run was completed in only one direction, however, SSC’s Tuatara technically still retains the official two-way average production car record at 282.9 mph (455.3 km/h).

Even so, it was a headline-grabbing run that instantly placed BYD’s halo car in rare company. Keen to showcase that achievement to a broader audience, BYD recently invited Richard Hammond to become the first Western journalist to drive the car. The result makes for compelling viewing.

As Hammond admits in his latest DriveTribe video, he doesn’t exactly have the greatest reputation when it comes to driving extremely fast, ultra-powerful cars. In 2017, he crashed the all-electric 1,224 hp Rimac Concept One while filming The Grand Tour. Back in 2006, he was seriously injured after crashing a dragster on the set of Top Gear.

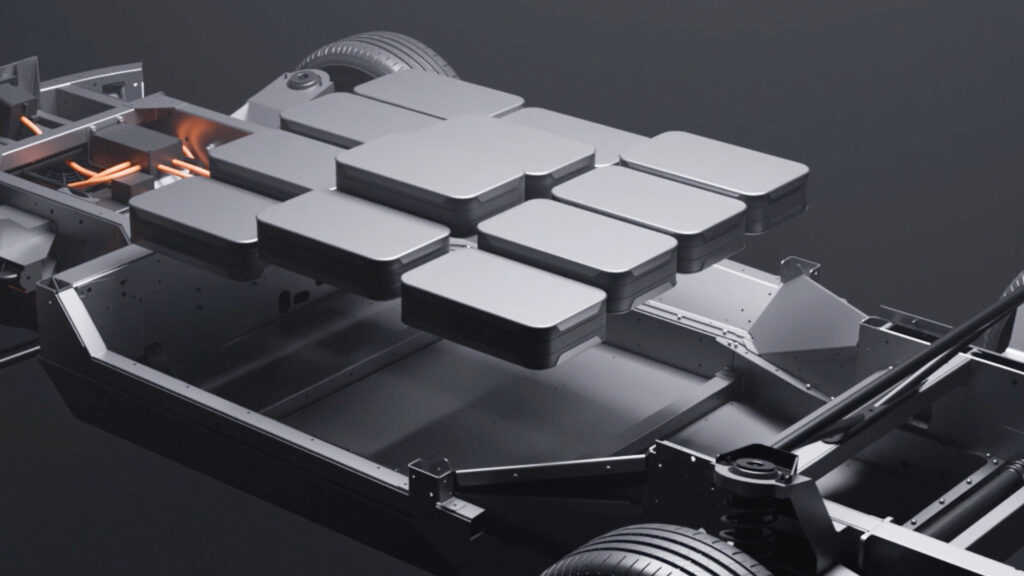

BYD obviously put a lot of faith in him to keep the U9 Xtreme in one piece, particularly given that this four-motor electric beast delivers a maximum of 2,978 hp, more than any other production car.

Rather than driving it on the road, Hammond was able to put it through its paces on a racetrack. Understandably, he appears to take things quite easily, which is hardly a surprise given that a BYD test driver spun up the car’s wheels the day prior and crashed into a barrier. It would seem as though having almost 3,000 hp under your right foot requires a lot of care. Who would have thought?

Hammond Tests Xiaomi Too

Interestingly, this isn’t the only recent video that Hammond has made in China. Late last year, he joined what could best be described as the Chinese version of Top Gear, alongside three hosts for a road trip. In this video, he drove three of China’s most impressive new EVs: the Xiaomi SU7 Ultra, the ‘regular’ YangWang U9, and the luxurious Maextro S800.

The clip was originally shared only on Chinese social media but has since been translated and uploaded to YouTube for our viewing pleasure. It’s well worth a watch.